oklahoma franchise tax return form

Mail this return in the enclosed envelope. These elections must be made by July 1.

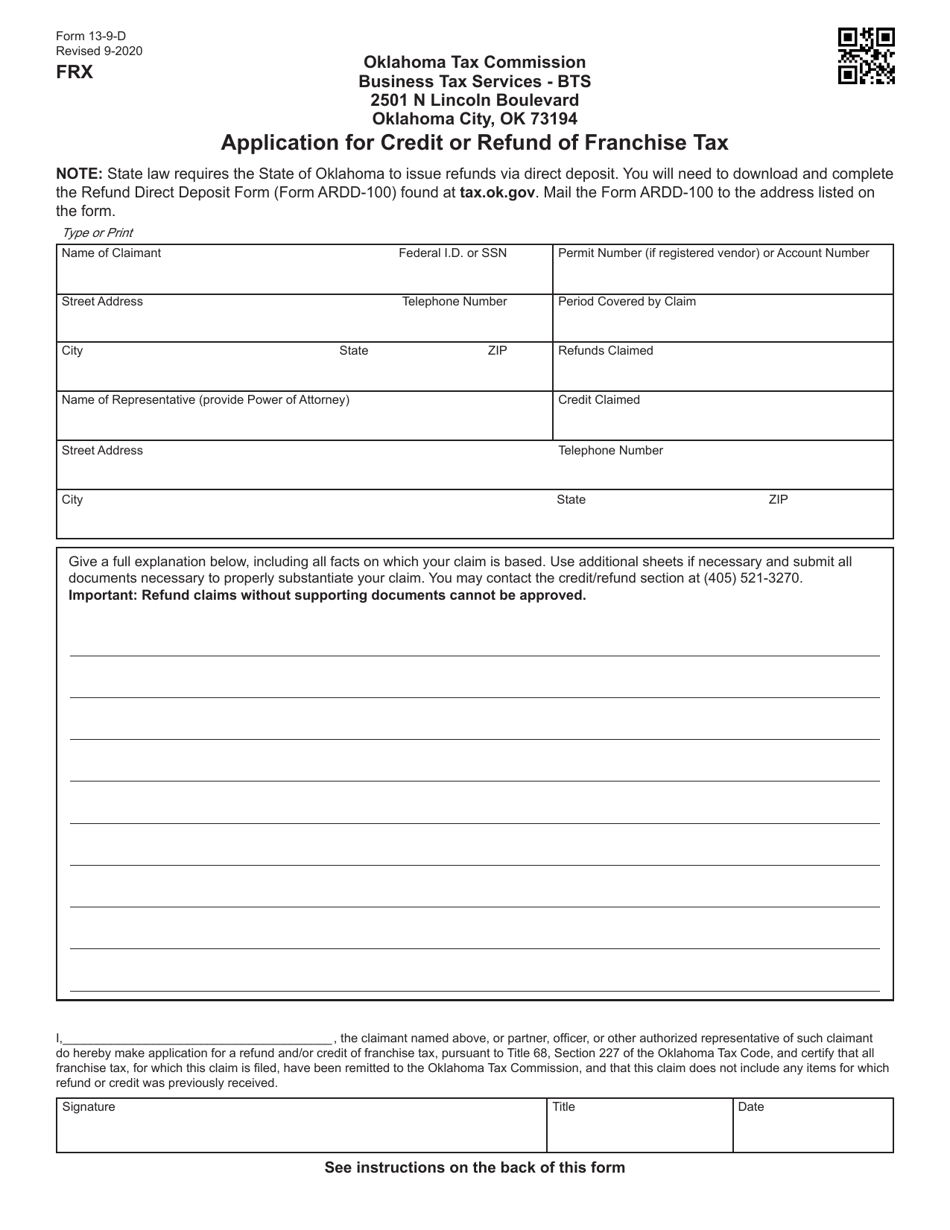

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512.

. Corporations filing a stand-alone Oklahoma Annual Franchise Tax Return Form 200 or who are not required to file a franchise tax return should. Download Oklahoma Annual Franchise Tax Return 200 Tax Commission Oklahoma form. See page 16 for methods of contacting the Oklahoma Tax Commission.

For assistance or forms. Your Oklahoma return is due 30 days after the due date of your federal return. You might also file your return with your social security number instead if you own a multi-owner LLC partnership and the members are filing individual income tax returns with IRS Form 1040 and Form 1065.

Your Oklahoma return is due 30 days after the due date of your federal return. Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date. To make this election file Form 200-F.

Oklahoma Annual Franchise Tax Return State of Oklahoma 2019 Oklahoma Corporation Income and Franchise Tax Forms State of Oklahoma 2021 Form 514 Oklahoma Partnership Income Tax Return Packet Instructions State of Oklahoma Application for Oklahoma UI Tax Account Number OES-1 State of Oklahoma. Complete the applicable income tax schedules on pages 3 4 and 5. Mine the amount of franchise tax due.

You can print other Oklahoma tax forms here. Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. See page 16 for methods of contacting the Oklahoma Tax Commission OTC.

Oklahoma Annual Franchise Tax Return State of Oklahoma form is 4 pages long and contains. Related Oklahoma Corporate Income Tax Forms. We last updated the Corporate Income Tax Return form and schedules in January 2022 so this is the latest version of Form 512 fully updated for tax year 2021.

How Is Franchise Tax Calculated. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or employed in Oklahoma.

A ten percent 10 penalty and one and one-fourth percent 125 interest per month is due on payments made after the due date. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Foreign corporations are not obliged to pay the Oklahoma franchise tax but are still liable for the 100 registered agent fee.

Oklahoma Tax Commission Franchise Tax Post Office Box 26920 Oklahoma City OK 73126-0920 Phone Number for Assistance 405 521-3160 Mandatory inclusion of Social Security andor Federal Employers Identi-fication numbers is required on forms filed with the Oklahoma Tax Com-mission pursuant to Title 68 of the Oklahoma Statutes and regulations. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma City OK 73126-0930 Phone Number for Assistance 405 521-3160. Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date.

See page 16 for methods of contacting the Oklahoma Tax Commission. All forms are printable and downloadable. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to.

Item C Place the beginning and ending reporting period MMDD. The report and tax will be delinquent if not paid on or before September 15. Complete the Oklahoma Annual Franchise Tax Return Item A Place the taxpayer FEIN in Block A.

Please include your return payment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. Complete Sections One and Three on pages 1 and 2. You can download or print current or past-year PDFs of Form 512 directly from TaxFormFinder.

For assistance or forms. Item B Enter the Account number issued by the Oklahoma Tax Commission beginning with FRX followed by ten digits. To make this election file Form 200-F.

Your Oklahoma return is due 30 days after the due date of your federal return. Once completed you can sign your fillable form or send for signing. Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date.

Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999. If no number has been issued leave blank. Oklahoma City OK 73126-0850 This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to.

Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. NOT complete the franchise tax portion of the return. Oklahoma Annual Franchise Tax Return State of Oklahoma On average this form takes 62 minutes to complete.

Elect to file a combined corporate income and franchise tax return.

What Is Privilege Tax Types Rates Due Dates More

What Is Franchise Tax Overview Who Pays It More

State Corporate Income Tax Rates And Brackets Tax Foundation

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Change Please A Tax Practitioner S Guide To F Reorganizations Frost Brown Todd Full Service Law Firm

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

California Tax Forms 2021 Printable State Ca 540 Form And Ca 540 Instructions

Taxpayers Federation Of Illinois Illinois Franchise Tax Still A Bad Idea

Oklahoma Tax Commission Facebook

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise

Reciprocal Agreements By State What Is Tax Reciprocity

Taxamize Accounting Provides Tax Preparation Remedies By Irs Approved Professionals We Specialize In Enlightening Ou Payday Loans Payday No Credit Check Loans